Tax Incentives 2025: Window Replacements Still Among the Eligible Interventions

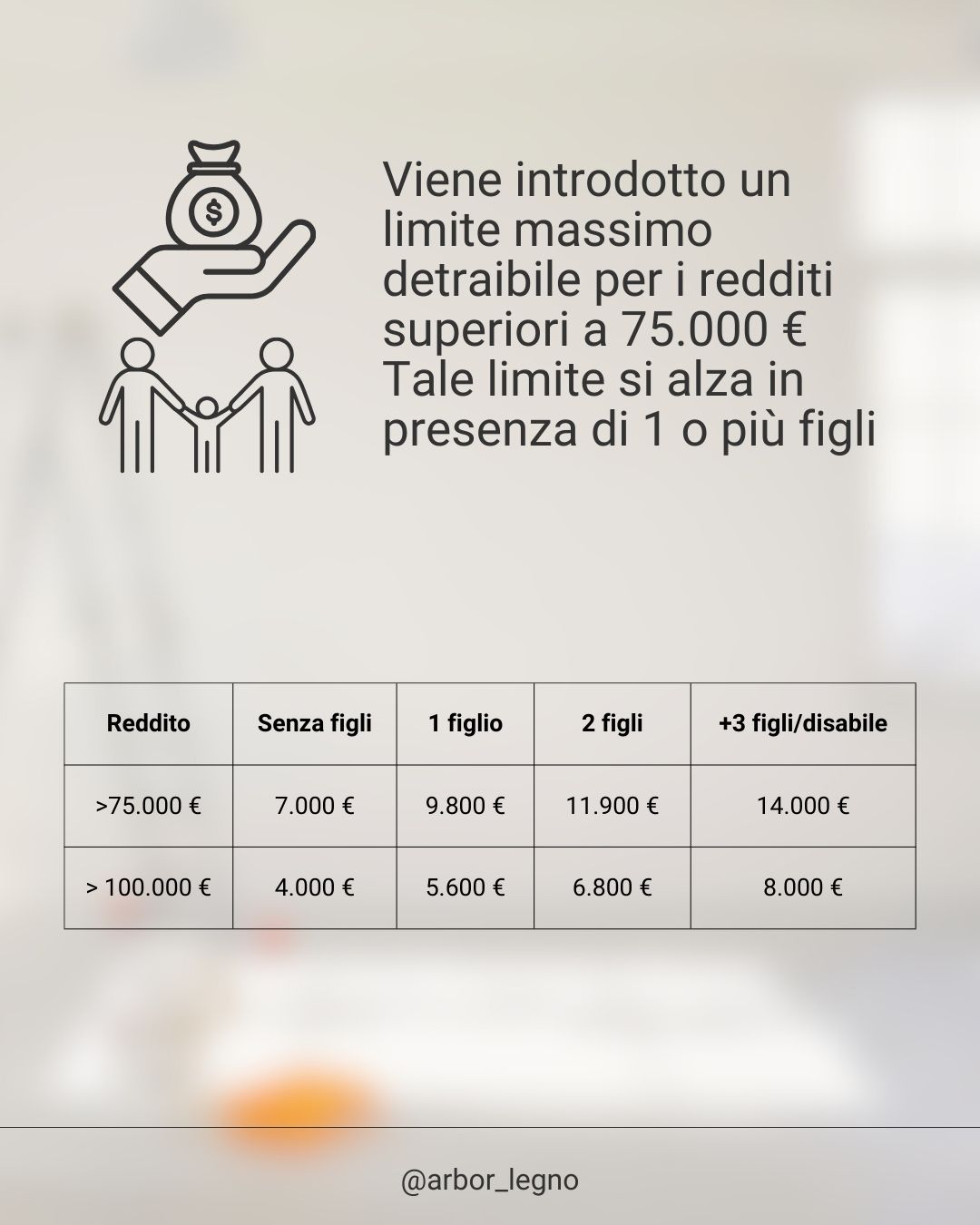

The 2025 Budget Law introduces important updates in terms of tax incentives for homes, offering new opportunities for those who wish to invest in building renovation and energy efficiency. Among the key changes is the gradual reduction of tax deductions for building recovery and energy efficiency interventions, along with the confirmation of home, safety, and eco-bonuses.

In this context, choosing high-quality materials like wood becomes a winning strategy for improving your home with sustainable and durable solutions.

Tax Incentives for Building Renovation and Energy Efficiency

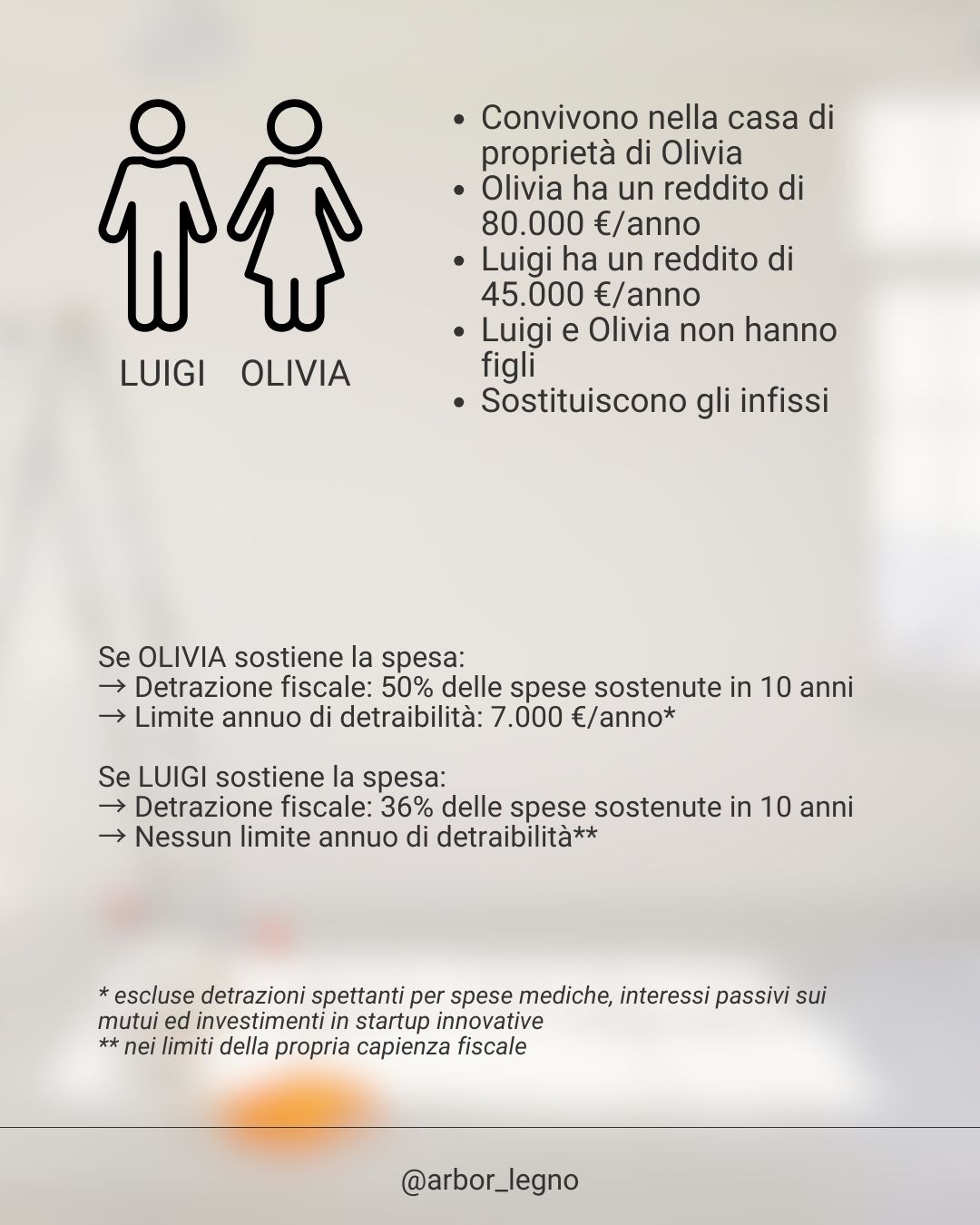

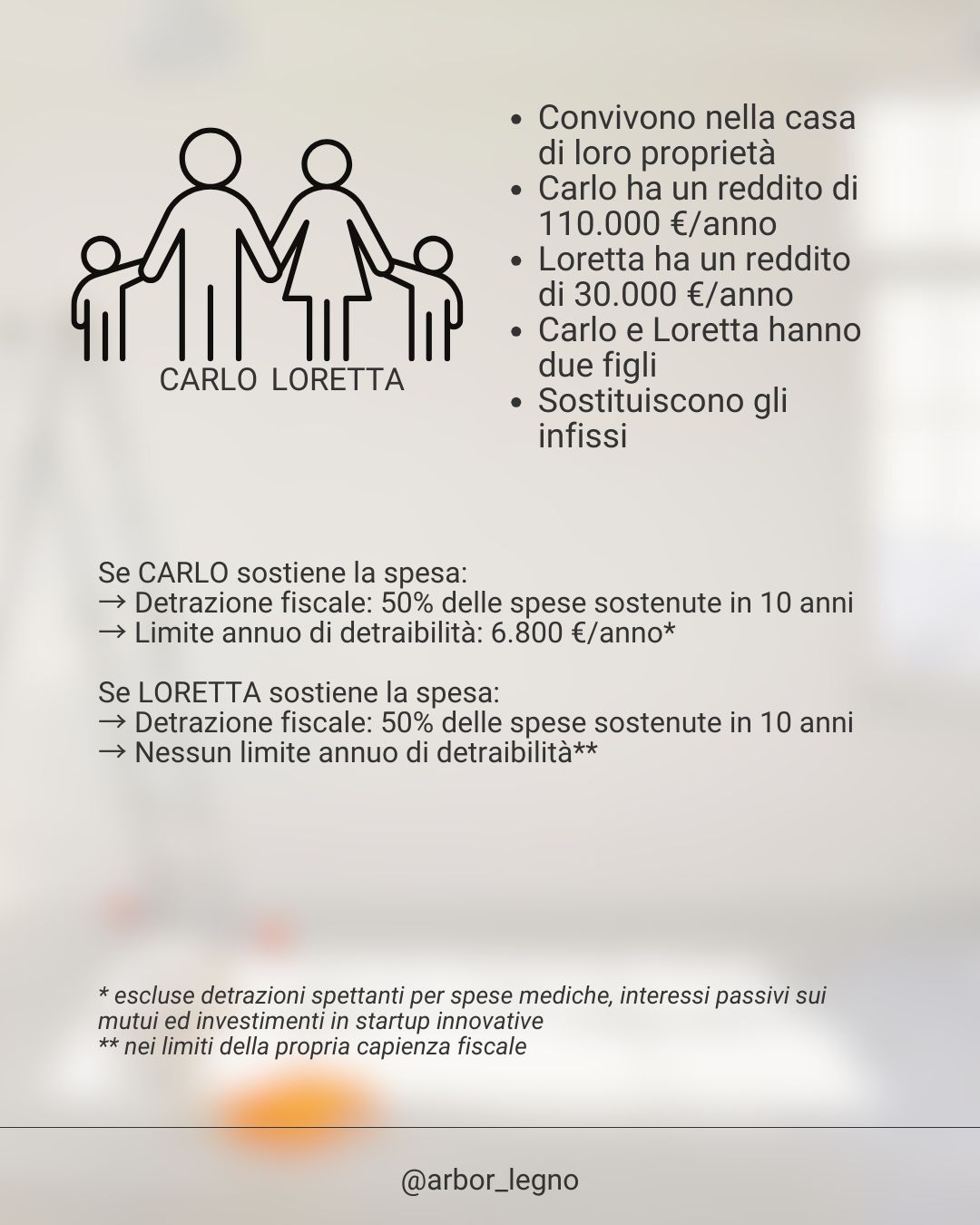

For all of 2025, window replacements remain among the incentivized interventions, with a tax deduction of 50% for primary residences and 36% for other properties.

Starting January 1, 2026, the tax deduction for building recovery and energy efficiency expenses will undergo a progressive reduction:

- For primary residences: the deduction will decrease from 50% to 36%.

- For other properties: the deduction will drop from 36% to 30%.

When it comes to windows, choosing products that guarantee high energy performance and long durability is crucial. In this scenario, wood remains an undisputed protagonist: natural, insulating, and renewable, it represents an excellent solution for those wishing to combine aesthetics and energy savings. High-quality wooden windows improve thermal insulation, contributing to energy consumption reduction and increasing the value of the property.

Investing in the Home with Informed Choices

The new tax incentives 2025 emphasize the importance of investing in one’s home with a long-term perspective: improving thermal insulation, regulating indoor temperatures, and optimizing systems are all actions aimed at reducing primary energy consumption for a more sustainable future.

Replacing windows with new wooden windows allows for combining excellent performance with beauty and sustainability.

At ARBOR, we work to offer quality and durability in our products, made with certified profiles and high-quality materials to ensure excellent performance over time.

Taking advantage of tax incentives to improve your home with wood is a choice that pays off both today and in the future, because a wooden window can become antique, but never old.